Online BBA in Finance Management is an undergraduate degree programme that is also offered in an online format that prepare students with the knowledge and skills in financial management principles and theories. This program usually takes from three to four years in order to complete and the field that is being given much attention covers topics like financial accounting, corporate finance, investment analysis and others such as financial market and risk management.

Online BBA Course in finance management provide knowledge on financial statement analysis, economic understanding and how to control risks and make investment decisions amongst others. Common courses are found in economics, business law, statistical analysis, and strategic management and provides a general business education with a concentration in finance.

Importance of Finance Management in Today's World

Online BBA Course in Finance Management has become crucial in the global marketplace as it helps in resource allocation, business expansion and maintaining economic stability. Management of finance is important in the promotion of organizational effectiveness that enhances the probable profits, reduces probable losses, and controls the risks over costs. They also help in making appropriate investment decisions thereby making possibilities for wealth buildup and funds security more achievable. In a macro scale, financial reporting practices work towards restoring public confidence and growth of the market that in turn helps the growth and development of the economy.

Why Choose an Online BBA in Finance Management?

- Selecting an Online BBA Course in Finance Management offers numerous advantages. The flexibility of online classes, enable students carry out academic programs together with their other activities like work and family. This helps learners to take their courses from the comfort of their homes or workplaces eliminating the need to travel in search of a university that offers their program of interest.

- One of the key benefits of implementing online classes is the ability of the students to set their own timetable and to work according to personal and/or career commitments. Assistive technologies, including forums, videos, and home-work assignment modules, supplement this learning model by creating an environment that is active and engaging with people as well as teaching mentors.

- Most programs offer internships, case studies and projects into their curriculum so that learners can put into practice the knowledge they acquire in their classes. Graduates are equipped to take positions in the banking sector, investment companies, corporate finance divisions or departments, and financial consulting, or for pursuing the master’s degree programs in finance or any other related major.

- Another benefit is that it is cheaper to implement as compared with other ways of getting the word out. Online programs are considerably cheaper than conventional on-campus programs since students are charged less tuition fees while most physical necessities, like transportation and accommodation, are not required.

- Online BBA Course in Finance Management provides chance for students to gain essential employability skills that are admired in the world of finance business including analytical mind, mastery in financial analysis and strategic planning. Banking and related sectors, including investment firms, corporate finance, and financial consulting offer a host of excellent career options for graduates to actively pursue and make a difference in their working lives with the essential professional skills and up-to-date knowledge.

Books suggestion For Online BBA in Finance Management

- Financial Management: Theory and Practice by Prasanna Chandra

- Corporate Finance by Aswath Damodaran

- Investment Analysis and Portfolio Management by M. Ranganatham and R. Madhumathi

- Financial Markets and Institutions by L.M. Bhole and Jitendra Mahakud

- Security Analysis and Portfolio Management by Punithavathy Pandian

- Management Accounting by Khan & Jain

- Principles of Corporate Finance by Richard A. Brealey, Stewart C. Myers, and Franklin Allen

- Fundamentals of Financial Management by James C. Van Horne and John M. Wachowicz Jr.

- Options, Futures, and Other Derivatives by John C. Hull

- Financial Statement Analysis by George Foster

Career Opportunities in Finance Management

- Financial Analyst

The financial analyst provides assessment of potential investments, financial reports’ analysis, and advice for the businesses and organizations who seek their services so as to make appropriate financial decisions. They analyze the economy, make projections of economic situations, and produce the relevant financial reports.

- Investment Banker

Investment bankers assist companies in raising capital by underwriting and issuing securities. They also advise on mergers and acquisitions, restructurings, and other significant financial transactions. This role requires strong analytical skills, deep understanding of financial markets, and the ability to handle high-pressure situations.

- Financial Planner/Advisor

Personal financial planners or consultants assist their clients in managing their money and reaching personal financial objectives, and they can deal with areas for instance, retirement, investment, and taxation. Bank employees adapt the opinions to the scans of clients’ financial status, preference toward risk, and goals and aims.

- Corporate Finance Manager

Corporate finance managers are responsible for controlling and planning relevant activities such as company budgeting, financial prognoses, and cash flow management. It is their duty to manage and improve the financial status of a business, to decide where to allocate resources, and ensure that the fiscal condition of the company is good.

- Risk Manager

A risk manager is responsible for the assessment and management of potential hazards regarding money concerns in a given company. They formulate processes that help minimize or mitigate risks that threaten organization’s resources and sustainability. This role frequently entails using various types of financial models and risk identification instruments to forecast possible problems or inefficiencies and their prevention.

- Credit Analyst

Credit analysts carry out credit granting by assessing the ability of an individual, or a business organisation to repay a loan on the basis of a credit report and financial statements. They estimate the probability of receiving credit and suggest different credit limits and proposed terms for a loan. This role is very vital in the financial sector such as in banking and credit rating firm.

- Portfolio Manager

Portfolio managers manage investment portfolios to fund predetermined objectives. They come up with choices with regard to portfolio diversification, choose securities, as well as portfolio performance. This position demands considerable amounts of analytical work and operations involving investment strategy formulation and implementation.

- Accountant

Accountants must complete various tasks, including preparing reports, verifying accounts, and reporting financial violations. Some of the anticipated tasks include filing of taxes, auditing and issuing of financial reports. There are several employment fields of accountants, such as the finance departments of companies and organizations, accounting companies and agencies, and the government.

- Treasury Manager

Treasury managers are tasked with the responsibility of overseeing a firm’s cash flow and making certain that the firm will be able to honour or meet its obligations. They are also responsible for managing of the company’s investments, holding authority over all the banking affairs, and designing various solutions for an efficient financial cash flow.

- Insurance Underwriter

Insurance underwriters evaluate the probability of being able to underwrite certain clients, also they decide the terms of offering an insurance policy. They use analysis to come up with an evaluation of risks as to underwrite insurance and for how much, therefore making them so crucial to the insurance markets.

- Financial Consultant

Financial consultants are professionals who specialize in giving clients useful tips on the way forward as far as their investment, financial planning, and risk management is concerned. They can be self-employed, or are practicing with a consulting firm to offer their service to improve organizations’ financial status and assist to realize their goals.

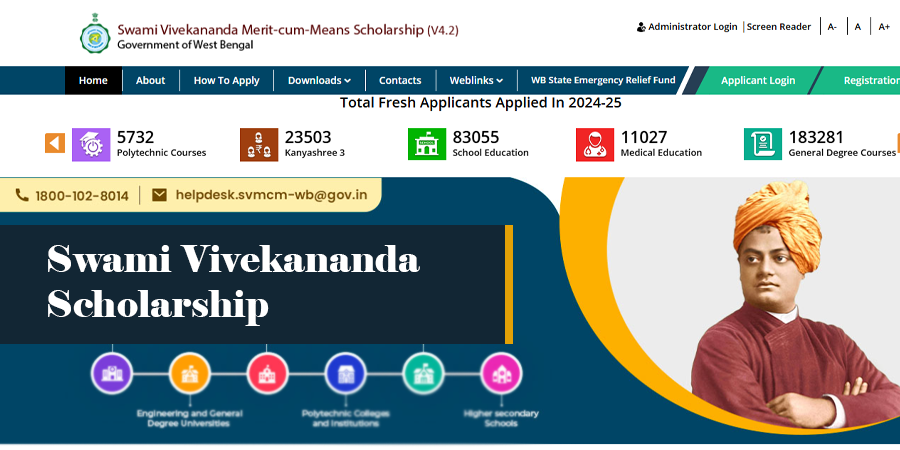

Top Universities Offering Online BBA in Finance Management

- Amity University Online

Online BBA in Finance Management offered at Amity University Online covers critical areas within financial management including; budgeting, investment, and operation’s risks management. Program focus is to give a proper business administration knowledge with a field of specialization in finance.

- Manipal University Jaipur

Manipal University Jaipur offers an online BBA in Finance where the core concepts as well as tools and techniques used in fields like financial markets, corporate finance, and investment analysis are studied. The program is also composed of projects and case analyses, thus gearing the students toward different monetary positions.

- NMIMS Global Access School for Continuing Education (NGA-SCE)

Online BBA in Finance Management is provided by NMIMS and is taught under its Global Access School. With its focus on financial accounting, management accounting and financial management, the program prepares students with the right skills needed for the finance world.

- Indira Gandhi National Open University (IGNOU)

The programme with Online BBA in Finance is offered by IGNOU’s School of Management Studies. This programme is more general in academic nature and aims at offering the fundamental areas such as the financial accounting, business environment and cost accounting, which can be delivered in flexible methods.

- Sikkim Manipal University (SMU-DE)

SMU-DE provides online BBA course in finance which is conducted through distance education system and it deals with the management of finance and economic policies for investment. This program is designed in such a way that it can easily fit into the busy schedules of professional or students who immerged in other pursuits.

- Lovely Professional University (LPU) Distance Education

LPU provides an Online BBA in Finance that encompasses details such as financial accounting, fund management, and corporate finance. This has also made it easier for the learning program to contain interactive tools and practical assignments which make the learning easier and effective.

- Uttaranchal University

Uttaranchal University offers online BBA course in Finance Management through distance education to offer a detailed knowledge of the financial theory and operations. It is a program that has been designed to provide students with practical knowledge for succeeding in the field of finance through offering normal, online classes with a preference for the current working world.

- Jain University

Online BBA Course in Finance Management from Jain University which has been developed to prepare students to become individuals capable of meeting various financial challenges and possess necessary knowledge when working on company-related tasks and projects for bachelor’s degree online for working people. High concentration on practical learning and curriculum development makes the program relevant to the job market and graduates have adequate skills for pursuing their careers in finance and management.

Syllabus of Online BBA in Finance Management

Online BBA course in India having specialization in Finance Management curriculum consists of projects, internships, or cases, and mastering theories of finance as well as their application in a working environment is also a focus. The competencies in soft skill and ethics in finance are also essential in the program to ensure that all financial professionals are trained comprehensively.

Semester-I | Semester-II |

English Business Management Business Accounting Business Environment Quantitative Techniques | Marketing Management Organization Behaviour Management Accounting Corporate Finance Communication |

Semester-III | Semester-IV |

Business Analytics Managerial Economics Tax Management Business Technology Environmental Science | Advanced Accounting Tax Management Advanced Finance Entrepreneurship Elective-I |

Semester-V | Semester-VI |

Investment Analysis Research Methodology Managerial Effectiveness Elective-II Elective-III | Operations Management Strategic Management Ethics and Values Elective-IV Project |

Admission Requirements

- Educational Qualifications: Applicant must have completed 10+2 higher education or equivalent from UGC recognized University with minimum of 50% marks.

- Documents Required: Higher Education passed Marksheet, Aadhar Card, 10th Marksheet, Migration Certificate, Transfer Certificate, and any other document if filled in the application such like EWS, Category Certificate, or any other else.

- Interview: Some University enrol directly while some conduct interviews or group discussions for selection.

- Work Experience(Optional): Some programs may require relevant work experience for pursuing online program.

Other Mode of BBA in Finance Management

Regular Full-Time BBA:

Consistent and Complete Bachelor of Business Administration in Finance Management in India can take up to three years of education and aims at providing the students a complete package of ideas and tools in the field of finance and improvement of business organizations. The curriculum covers a strong focus on the fundamental subjects like financial accounting, corporative finance, investment, banking, financial markets and risk management. Some of the other essential courses incorporated are basic principles of economic, laws related to business, marketing concepts, organizational behavior, and management of strategic initiatives.

Classroom learning is important as it among other things enables direct engagement with the faculty and other students which is crucial for interpersonal as well as communication skills. In some instances, internships, projects, and case studies may be used as a part of the program to offer a simulation of the actual environment which the learner is likely to encounter and get exposure to real-life situations and actually engage in the analysis and decision of financial issues.

BBA programs are highly competitive in the contemporary society and are offered in great institutions such as Delhi University, Mumbai University, Christ University and Symbiosis International University. Specifically, these universities are equipped with libraries, laboratories, and firms, which are fundamental for the overall curriculum. Additional opportunities, sports, games, competitions, seminars, workshops and guest lectures by the visiting industries add more values to academic sessions. This way, there

Part-Time BBA:

A part-time BBA in Finance Management in India is intended for the professionals who have a job or want to have work-study balance and obtain education meanwhile. This program normally takes 3-4 years of study, providing the flexibility of evening/weekend classes for students who could be engaged in paid work or other responsibilities this will be likely to be the case for some students as courses offered are likely to be in the evening or during weekends. These courses denote fundamental business courses that enable the students to learn fundamental concepts such as financial accounting, corporate financing, investment, banking and risk management among others. Other requirements also include courses in economics, business law, marketing, strategic management, and organizational behavior. Great emphasis is placed on the enhancement of the analytical skills with references to a number of courses, including statistics and financial modeling.

Students develop a combination of academic learning and practical application, whether in individual or group assignments, simulated activities, or internships. The flexibility of the part-time model ensures students apply lessons from their class as soon as possible in their present occupations for professional development and dissemination of finance knowledge. It offers a range of advantages, as classes are frequently held with individuals from various professions, allowing interaction during the learning process. The program also encompasses other related personal competencies like leadership, communication, and ethical reasoning skills to make the human being a versatile candidate suitable for any managerial position in the financial management sector of various industries.

Distance Learning BBA:

A Distance Learning BBA in Finance Management in India courses is planned with open flexible schedule classes for students who cannot attend the regular campus of learning because of some or the other issues. The kind of programs, which are offered by IGNOU and SCDL are very famous among the people from different parts of the world. It usually comprises core business courses for example: managing people, business communication, and organizational culture and structure together with corporation finance courses like: financial accounting, securities trading, business finance, financial systems, and risks management. Other basic courses include quantitative subjects such as business mathematics and statistics while other important segments include effective communication skills like business communication, interpersonal communication, public speaking as well as computer literacy.

Distance learning programs adopt educational technologies, such as online classes, presentations, computer assisted learning, virtual classes, and message boards. Tests, quizzes, assignments and projects which are on emanating schedule, examinations check on the level of mastery of conceptual financial frameworks by the students. Flexibility is another feature because students can be enrolled in classes depending on their schedules and can learn in their own pace while attending other activities. In this case, these programs incorporate values of mentorship, online library, and career guide among others.

Integrated BBA-MBA Programs:

The Integrated BBA in Finance Management is a program with a duration of 5 years which provides the students with both the BBA at the undergraduate level and MBA at the postgraduate level in the field of finance in an accelerated and efficient manner. This program incorporates the core courses of business while also offering students specialized finance classes that will enable them to get entry-level jobs as they develop their leadership skills on the job. Core subjects presented for this curriculum contain financial accounting, economics, marketing, business law, and organizational behaviour, offering a solid business foundation. At advanced levels, more specifically field related areas of study are covered – corporate finance, investment analysis, risk and return, financial markets, corporate decisions, etc.

Practical training is also an important component as it comprises of internships, projects, and case studies that provide a base of real life experience market exposure. This may also be in the form of ‘executive training,’ where aspects of soft skills like communication, leadership, and ethical practices in finance are imparted for the all-round development of students and professionals. This format make it possible to study finance comprehensively and in detail without having to spend or take the same amount of time as it would take to complete a BBA then an MBA in the traditional pattern. The graduates of this program leave this program well armed for any employment opportunities that may present themselves to them, be it in the public or private sector with the ability of analyzing and manipulating complex financial issues that may be encountered in the working environment within the finance field.

Specialization of BBA

Summary

Online BBA course in the field of finance management in India help students acquire core financial education in a convenient learning process. These programs include areas like financial reporting, analysis and management, investment, and organizational finance guaranteeing graduates job positions in the finance sector. The students have web campuses through which they interact with their tutors, therefore, receiving quality education from the comfort of their homes, particularly for adults who work or have other responsibilities. Upon completion of their course, they acquire the necessary skills to seek employment with banking and investment firms or corporations for a better future in the burgeoning finance industry of India.