The online BBA in FinTech program is designed for aspiring professionals; this online program offers a unique combination of core business administration skills and advanced knowledge in the field of financial technology. In an online delivery format, the program provides students with knowledge about blockchain and other digital currencies, as well as acquiring skills in advanced financial analysis to equip them with skills to work in leading financial services organizations. Become a member of a progressive learning environment and develop the necessary theoretical and practical knowledge to succeed in the fast-growing field of financial technology.

What is a BBA in FinTech?

Advantages of Pursuing Online BBA in FinTech

- Pursuing an Online BBA in FinTech offers convenience or flexibility. Students can review course materials, view lessons and complete assignments from anywhere, at any time to suit their schedule. The flexibility of learning is especially important for a working adult or a person with other engagements since it allows them to study while also attending to other duties.

- Online BBA in FinTech is a program that consists of a comprehensive course offering in business administration as well as up-to-date concepts and theories in financial technology. Students receive profound knowledge of blockchain, digital currencies, financial analytics, and cybersecurity. This kind of education enables graduates to comprehend and effectively apply technological trends in the financial industry, thus making them employable in the job market.

- The FinTech industry is now expanding worldwide, and there is an increasing need for people with knowledge about both business management and financial technologies. The knowledge that students obtain while studying for their online BBA in FinTech prepares them for numerous occupations in banking and financial service industries, technological companies, and start-ups.

- Pursuing an Online BBA in FinTech is much cheaper compared to the normal on-campus-based education programs. Students could find that they spend less on transportation and accommodation. Also, almost all online classes come with financial aid, scholarships, and affordable payment options, hence increasing the chance of students attaining higher education.

- Online BBA in FinTech programs often attract a diverse student body from different parts of the world. This diversity enhances the learning experience because it encourages students to develop an international outlook as they learn about financial technology and business. Knowledge about different markets, legal requirements, and cultures can be very helpful for individuals who are interested in working in various countries in FinTech.

- The FinTech industry is fast growing, and there is always new development or innovation taking place. An online BBA in a FinTech program ensures that the learner approaches changes as a continuous learning process and, as a result, has the right mindset to embrace the change. FinTech as a field is constantly growing and shifting, and thus, one must be able to learn and adapt continually to be successful in the long term.

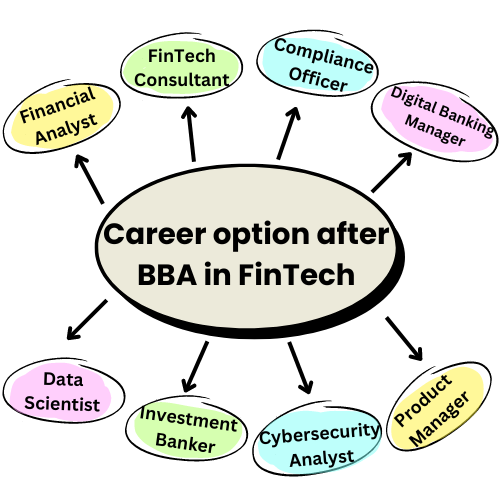

Career Options after BBA in FinTech

Financial Analyst

Financial analysts analyze financial information and compile forecasts and recommendations for companies and other institutions. Overall in the FinTech industry, they apply superior analytical methods and technologies to analyze market dynamics, investment, and risk. Knowledge in the economic field and IT field helps them to introduce changes to financial processes.

FinTech Consultant

FinTech consultants are professionals who help other companies on how to adopt and apply financial technologies in their operations. They consider the existing state of the company’s financial processes, find inefficiencies, and propose FinTech improvements, including blockchain or digital payments and cybersecurity tools. Their objectives include simplifying the process and processes, minimizing costs, and increasing the effectiveness of the processes.

Compliance Officer

Compliance officers are responsible for monitoring organizational activities to maintain compliance with relevant legal requirements, as well as standards and best practices in the industry. While operating in the FinTech industry, they specialize in topics like AML regulation, KYC, or data protection legislation and regulation. This way their knowledge is helpful in preventing legal issues that may be hard for companies to traverse when dealing with regulatory institutions.

Digital Banking Manager

Digital banking managers have the responsibility of managing the processes involved in the provision of digital banking services, like online banking platforms, mobile applications, and digital payments. Their goal is to improve the customer journey by leveraging the features of financial technologies and to provide secure transactions.

Data Scientist

Data scientists work with big data, and their key function is to explore patterns in the gathered information that may be helpful in making business decisions. Professional and highly skilled statisticians apply sophisticated statistical, machine learning and data visualization methods in order to analyze financial data and identify tendencies. Current studies enable fields like risk evaluation, fraud identification, and individualized financial solutions.

Investment Banker

Investment banker in the FinTech sector deals with the mobilization of funds for FinTech upstarts, mergers & acquisitions, as well as Initial public offerings (IPOs). They use their experience in the financial markets and their understanding of the potential of the new technologies to deliver advisory and transactional services designed to help FinTech companies grow and develop.

Cybersecurity Analyst

Cybersecurity analysts work to safeguard FinTech organizations from cyber threats and data breaches. They are responsible for creating and enforcing security measures, performing security audits and exercises, and handling security breaches. The function is fundamentally aimed at safeguarding the accuracy and security of financial information and customer satisfaction.

Product Manager

A FinTech product manager is an individual responsible for managing and launching financial technology products to meet consumer needs. They work closely with cross-functional teams, including developers, designers, and marketers, to create products that meet customer needs and drive business growth. Their role involves market research, product strategy, and project management.

Syllabus of BBA in FinTech

BBA in FinTech program includes typical business courses like economics, accounting and management, but also offers more specific FinTech courses. Topics are pertinent to technology, legal issues, banking and finance, digital money and virtual currencies, and quantitative analysis. Students study programming languages, knowledge management in finance, data science, and machine learning. It comprises three areas of practice, which are financial regulation, risk management and innovation. The approach enables the knowledge to encompass both conventional finance and technology in equal measure.

Here is the common Syllabus for BBA in FinTech in different universities:

Semester-I | Semester-II |

· Introduction to FinTech · Business Mathematics · Management Accounting · Operation Management · Financial Markets | · Business Statistics · Financial Institutions · Organizational Behaviour · Communication Skills · Quantitative Finance |

Semester-III | Semester-IV |

· Financial Management · Marketing Management · Python for Finance · Human Resources Management · Environmental Science | · Computer Applications · Entrepreneurship Development · Research Methodology · FinTech Ethics and Risks · AI and Machine Learning |

Semester-V | Semester-VI |

· Strategic Management · Financial Derivatives · Trading Strategies · Payments and Crypto currencies · Summer Project | · Operations Management · FinTech Regulations & RegTech · International Finance · Research project · Internships |

What you get to learn in this specialization

Introduction to FinTech

Introduction to FinTech in BBA in FinTech offers a preliminary insight into the relationship between finance and technology. This course focuses on how technology is disrupting financial services and products such as mobile money, blockchain, crypto currencies, and AI. Students learn about the history of financial ecosystems, the necessary regulations, and trends influencing the sector. The focus is placed on practical aspects of the area, including financial analysis and risk assessment, which will enable the graduates to operate and thrive in the constantly evolving FinTech markets. The course combines theoretical concepts with practical experience, preparing students for jobs in banking, investments, and FinTech companies.

Financial Institutions

In the BBA in FinTech program, the knowledge of Financial Institutions is fundamental. Banks, insurance companies, investment firms, and other financial entities, along with their structures, functions, and roles, are studied in this subject. With developing technologies, students explore the development of these institutions with a special focus on economic stability and development. These are issues such as financial mediation, risk management, regulation, and digitization. When learning about Financial Institutions, students understand how these organizations adopt and implement FinTech solutions to improve business processes and increase access to financial services in a rapidly changing environment.

Python for Finance

Python for finance is an important part of BBA in FinTech since it combines programming competencies to solve financial problems. This subject provides fundamental knowledge of Python programming language for financial applications. Some of its topics include data manipulation and visualization, and statistical computation with tools like Pandas, NumPy, and Matplotlib. They learn how to code and automate workflow, construct models, and apply trading algorithms. It is suitable for analyzing real-world financial data and for simulating markets, thus making graduates ready for careers in quantitative analysis, financial risk management, and financial engineering.

FinTech Ethics and Risks

In BBA in FinTech programs, understanding FinTech ethics and risks is crucial. This subject examines the moral issues around financial technology developments, including data privacy and protection, fairness in the use of algorithms, and transparency inherent in the computerization of decision-making. It also explores cybersecurity threats and risks, the possibilities of noncompliance with regulations, and the financial volatility that technological expansion can cause. These questions help students understand such an alternative approach, how to work creativity and maintain trust and sustainability in new and existing financial frameworks. Understanding FinTech ethics and risks enables graduates to minimize issues they are most likely to encounter but also harness the potential that exists in the burgeoning financial tech industry.

AI and Machine Learning

Technology such as AI and Machine Learning in BBA in FinTech defines new frontiers of financial services through the ability to spot trends in large data sets, eliminate human error and intervene in decision-making. Students get to work with emerging areas using predictive analytics for risk management, algorithmic trading strategies, and customer behaviour analysis. It is vital to comprehend these technologies to create new financing products, optimize work, and adhere to the requirements set by the regulators. It is vital to comprehend these technologies to create new financing products, optimize work, and adhere to the requirements set by the regulators.

Financial Derivatives

Financial Derivatives form a critical component of BBA in FinTech, focusing on instruments whose value derives from the performance of underlying assets. This subject has the study of many different securities types like options, futures, swaps, and forward contracts, with emphasis placed on their uses of risk management, speculation, and hedging. By making use of mathematical models in the pricing of derivatives, the identification of opportunities in the market or the examination of the effects of derivatives on financial markets as they pertain to students. Integration of ‘real world’ applications related to digital finance and blockchain technology improves understanding of how derivatives relate to present-day innovations in finance, which will be useful to students entering their careers in investment management, quantitative analysis, and financial practice.

Payments and Crypto currencies

In the BBA in FinTech program, Payments and Crypto currencies form a crucial component, exploring the evolution of financial transactions in the digital age. This course enables students to explore the technical aspects of digital money, such as mobile wallets, online banking, and P2P transfers. Furthermore, the curriculum discusses the disruptive aspect of these crypto currencies, such as Bitcoin and Ethereum, where there is emphasis put on their decentralized and blockchain structures and their effects on the overall conventional financial structures. Using case analysis and live exercises, students learn about the legal and policy hurdles, security risks, and the paradigm shift that these solutions offer in redefining the landscape of international finance.

FinTech Regulations & RegTech

FinTech Regulations & RegTech examines the interface of regulations and technologies that support the financial industry. Students explore the legal governance surrounding digital banking, cryptocurrencies and blockchain technologies. Significantly more importance is given to global compliance descriptions, risk management strategies, and regulations that FinTech firms encounter. Furthermore, the application of RegTech solutions is considered with reference to its capabilities in regulation automation and optimization of the financial organizations’ functioning. It ensures that students in this course acquire the knowledge and skills required to help organizations deal with the regulatory framework in the promotion of innovation in the financial technology sector.

Top Universities offering BBA in FinTech

S.no. | Universities |

1. | NMIMS University, Mumbai |

2. | Symbiosis International University, Pune |

3. | Manipal University, Jaipur |

4. | Amity University, Noida |

5. | Christ University, Bangalore |

6. | Jain University, Bangalore |

7. | Lovely Professional University (LPU), Punjab |

8. | Chandigarh University, Chandigarh |

9. | SRM University, Chennai |

10. | FLAME University, Pune |

Eligibility Criteria for BBA in FinTech

- Candidates must have passed 10+2 or its equivalent examination from any recognized board.

- Applicants must have achieved a minimum aggregate score of 50-60% in 10+2 examinations (varies by institution).

- Candidates should normally be at the age of 18 to 23 years at the time they join the institution.

- Some institutions may require candidates to clear entrance exams like :

- Undergraduate Common Entrance Test (UGCET)

- Joint Entrance Examination (JEE)

- Institution-Specific Exams

Admission Process for Online BBA in FinTech

- It is important to check whether you meet the requirements for the program (educational achievements, minimum grades, age, and language).

- Fill out the online application form available on the university’s website and ensure that they fill in all proper and correct information.

- Upload required documents, such as:

- High school transcripts or mark sheets

- Proof of age (birth certificate or government-issued ID)

- Passport-sized photograph

- Any other documents specified by the university

- Pay the non-refundable application fee as specified by the institution.

- You have to Register and prepare for the entrance exam if required by the institution.

- You will have to wait for the university to review your test results for admission as well as your application.

- The institution communicates admission status to applicants after reviewing applications and conducting Interviews. Students who have been placed will be provided with an admission letter showing the next steps, including fee payment and Enrollment.

Books Suggested for BBA in FinTech

- “Blockchain Basics: A Non-Technical Introduction in 25 Steps” by Daniel Drescher

- “Digital Banking: The Roadmap to a Digital Ecosystem” by Luvleen Sidhu

- “Cryptocurrencies and Blockchain Technology” by Andrew L. Rossow

- “FinTech Innovation: From Robo-Advisors to Goal-Based Investing and Gamification” by Paolo Sironi

- “Data Science for Business: What You Need to Know about Data Mining and Data-Analytic Thinking” by Foster Provost and Tom Fawcett

- “Machine Learning for Asset Managers” by Marcos López de Prado

- “Cybersecurity and Cyberwar: What Everyone Needs to Know” by P.W. Singer and Allan Friedman

- “The Age of Cryptocurrency: How Bitcoin and Digital Money Are Challenging the Global Economic Order” by Paul Vigna and Michael J. Casey

- “Artificial Intelligence in Finance: A Python-Based Guide” by Yves Hilpisch

- “FinTech: Financial Technology and Modern Finance in the 21st Century” by Steven O’Hanlon

Some other specialisation of BBA

Data Science | ||

Healthcare Management |